The Russian invasion of Ukraine represents a change in the pre-existing perception that there will be no more wars in the West after World War 2.

None of the Western countries believed that the invasion would be on such a large scale. This issue – the Russian aggression as well as China’s intentions to realize her desire to conquer Taiwan – emphasized the need for unity within the NATO Alliance, and led all its members to the understanding that it should be maintained and cultivated.

One of the most significant fields affected by this invasion is the energy field and Europe’s dependency on Russian gas. Thus, there will be more and more changes in the investments of European economies as they seek to sever their dependencies on Russian energy and accelerate contingency plans for investments in those fields.

In addition, the serious damage to Ukrainian infrastructure and industry had a great impact on Western economies, on all of us. Even now, we already feel the significant rise in prices – but we have not seen the long-term effects of the economy yet. Every attempt to guess those long-term effects at this point is doomed to fail.

Here are some relevant topics for this year, and perhaps for the next few years:

- Minimizing dependency on Russian energy and raw materials.

- Minimizing dependency on other countries in terms of manufacturing products for internal consumption (de-globalization).

- Structural inflation resulting from rising production costs and structural changes in the production chain.

- Increasing storage and creating an internal supply chain within every country / manufacturing business.

- Covid-19 has remained, and while some countries, including Israel, have decided to live with it, it will still affect the supply of products / inflation.

Things that affected the results of the 1st quarter

- The war in Ukraine

- High inflation

These topics caused the central banks to adopt an offensive approach and take drastic steps to restrain those outcomes in the long term.

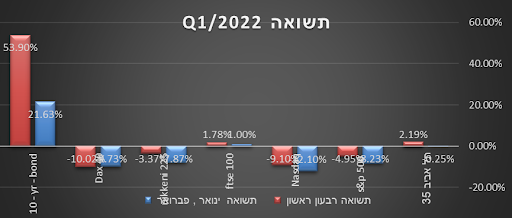

The stock market managed to recover, and the sharp declines of January and February were corrected in March; however, in most markets, the quarter still ended with negative returns. Nevertheless, Tel-Aviv 35 ended positive.

The bond market had the worst performances in the last 3 decades.

This figure shows that any person that had a 10 year bond from the US government has lost all the increasing returns in just the first quarter – nearly 13% of the money in bonds.

The markets’ correction in March is unusual for the rising interest environment: the cost of raising the companies’ debt is rising, which influences their profitability, but the correction in the markets stemmed from a sense of insecurity in the central banks’ ability to control the inflation, and from the biggest concern of all – whether they will be able to control it without significantly damaging the economy.

The Chinese stock market’s quarterly performance was worse than those of other markets. Limiting the exposure to this market during this period makes sense because of the Chinese government’s interference in companies with public offerings, which greatly damages the investing public’s trust in the Chinese economy, despite the predicted growth in product in 2022, a growth of 5%-6%.

In the bond market, the ‘solid’ and ‘stable’ financial asset that was supposed to be the less volatile and more stable part of managed funds, had the highest decline in three decades. This mostly stemmed from the rising inflation in the US, Europe, Israel, and the world in general.

One of the main problems is that the issue has been handled so poorly so far, and the fear that in order to control the inflation it will be necessary to raise the interest much more aggressively.

This is the first time in 3 three years that the Fed raised the interest. Although they only raised it 0.25%, the markets are predicting at least 3-9 additional raises, and it is

unclear whether it will only be 0.25% each time – there might be 0.5% raises at least twice. This information does not promote the markets’ feelings of calm.

Nevertheless, we know that the markets react too strongly in periods of fear, and we will see the predictions adjusting as the information becomes clearer. These developments will influence both the stock market and the bond market.

Unlike the Fed, the European Union has not managed to settle on an action plan that everyone agrees on. On one hand, Germany, Austria, and Holland want to harden their position and start to fight inflation. On the other hand, France, Spain, and Italy are still not ready to deal with the issue. The European Central Bank, however, stated that it will gradually reduce its expensive purchases of bonds, which will reduce the amount of money flowing into the markets.

In the next two months, the markets will be influenced by the following issues:

- Will the Fed execute the 9 predicted interest raises in the markets, amounting to 3% short interest, until the end of the 1st quarter of 2023?

- Will the Fed manage to execute a ‘soft landing’ of the markets and reduce the inflation without the market going into a recession?

- How will the prices of commodities affect global inflation? After the war in Ukraine, will it turn into a route of decreasing prices?

- Currently, the world seems to be divided in two – countries that we can have trading and business relations with, and countries that we can’t; then, the issue of global growth / inflation can be examined.

In conclusion

In the next few weeks/months, the volatility level will continue to be high; thus, you should save your extra funds in the account, and enter the capital market throughout the year, after the possible continuing corrections.

It is very important to diversify the managing funds in several different places (depending, of course, on the amount of managed funds); in addition, investing funds in several different investment products will diversify the risk of funds management.

The markets seem very volatile, and they will continue to be so. As the bond market’s returns continue to open up, we’ll see more and more investment managers collect ‘commodities’ and lock their returns for the rest of the year.